In the second decade of the current century, the Polish market of trade in food products, or, more broadly, FMCG, has taken on the features of maturity, simultaneously preserving its separateness in comparison with development of such markets in the adjacent countries. Let us recall that in the early 1990s, in the initial period of Poland’s political and economic transformation, the basis for these changes was the economic activity of the Polish people, unique against the European background. In effect, thousands of food wholesale companies and hundreds of thousands of retail stores were created. When international trade corporations, such as Carrefour, Metro, Ahold, Auchan, or Casino came to Poland, the Czech Republic, Hungary or Slovakia in the middle of the decade, the Polish market took up the fight for preservation with a completely different structure of wholesale and retail trade than in Western European countries. Whereas international companies quickly seized almost 80% of the markets of Poland’s neighbours, a peculiar equilibrium could be maintained in Poland for almost 20 years – about a half of the market was still held by small entrepreneurs. This was the case for more than 15 years. It has only started changing recently, not necessarily due to the competition from foreign companies. This is rather an effect of changes occurring in trade, not just in Central and Eastern Europe but worldwide.

Wholesale follows the leader

Of almost 10,000 food wholesale companies established – according to some estimates – in the first half of the 1990s, only several dozen significant ones have survived today and only a couple of those do not experience any problems. This part of the market has currently been dominated by the Eurocash Group which, focusing on cooperation with smaller trade outlets and having performed a range of spectacular investments over the recent years, has acquired more than 20% of the market and its leading position seems completely unthreatened. The company, self-describing as entirely Polish – which is true in the sense that it operates exclusively on the Polish market, even though there is Portuguese capital behind it – acquired its largest competitor, the Emperia Group, nearly twenty years ago, thus creating its present-day potential. Currently, Eurocash is a supplier for several dozen thousand retail stores, including approx. 15,000 franchise outlets in trade chains with capital ties to this company. With its annual turnover well in excess of 20 billion zlotys, the company finds no worthy “opponent” on the Polish market and everything seems to indicate it will not find one. With regard to their scale of turnover, the following companies are unquestionably Makro and Selgros, even though the sales they generate are several times lower than those of the Polish-Portuguese potentate. Both companies are sellers of a cash & carry nature.

Native Polish wholesalers have tried in vain to catch up with the leader. The relatively closest one is the Specjał Capital Group from Rzeszów, the only one that manages to reach the nationwide scale; however, its turnover is several times lower than those of Eurocash, currently getting close to 1.7 billion zlotys, with plans to reach 3 billion over the next 2 years. Specjał, just like Eurocash, builds its strength and position by creating a related franchise background, as well as by acquisition of both wholesale competitors and franchise chains.

Other wholesale companies are characterized by a much lower scale than the ones mentioned above, both in terms of territory and the level of turnover. Additionally, many of them struggle with numerous problems of financial and organizational nature. Bać-Pol, which used to operate on a scale comparable to Specjał until recently, is clearly limiting the scope of its operations today. This is a consequence of both management errors and loss of significant customers, including, above all, the Alma chain that failed to settle its many liabilities towards Bać-Pol when it went bankrupt.

Another significant wholesaler, Marol from Poznań, has closed more than a dozen branches, thus limiting its territorial scope of operations to areas with guaranteed profitability.

Several dozen medium-sized wholesalers, including those associated in the MPT Group (an organization associating several prominent wholesale companies, providing them with favourable commercial conditions thanks to the purchase scale), are concerned with maintenance of their hitherto position rather than with wider expansion. Most wholesale companies rather wish to retain their local market where they are strong and have a relatively firm or even predominant position.

In this context, the wholesale market, as a matter of fact, seems organized today. There is a leader, several big players, as well as local companies, and no major changes are to be expected.

Ordered retail

At the time when great international retail companies were entering Poland, there were more than 140,000 grocery stores operating on our market. There were concerns at the time that international capital would quickly “clean up” that market. However, it turned out not to be as easy as the managers had thought. Of course, competition made some small establishments disappear from the market, but not to such a wide scale as in the Czech Republic or Hungary. With the foresight of Polish retailers, their determination and the ability to act together, traditional trade managed to retain a strong position and to hold about a half of the market, in spite of reduction of the number of stores. At the turn of the first and second decade of the current century, more international companies (in terms of the scale of turnover) withdrew from the Polish market than retail stores collapsed. The Casino Group with its Géant hypermarkets has vanished, Ahold with Hipernova and Albert stores is no more, German Real sold itself to Auchan. Of course, many traditional stores have failed as well, but there are still almost 70,000 of them operating and their share in the market is estimated at more than 30%.

On the other hand, discount stores have become the predominant format on the market. These include, above all, chains of foreign origin. In total, Portuguese Biedronka, German Lidl and Aldi chains, as well as Scandinavian Netto already have more than 4,000 stores and have become the Poles’ favourite shopping places.

Meanwhile, the waning importance of hypermarkets is accompanied by increasingly better organization and development of family trade chains. Proximity supermarkets – convenient, of neighbourhood nature – do very well. For 2-3 years, this sector has been dominated by the Dino chain, followed by Polomarket, or the Mila chain owned by Eurocash. The Stokrotka supermarket chain experienced acceleration, having been acquired by the Lithuanian Maxima Group. The convenience format is undergoing development. Żabka franchise chain already has nearly 6,000 stores and is currently modernizing its mode of operation as well as offer. Fuel station stores are becoming increasingly important, emerging as real competitors for the traditional trade.

On the other hand, franchise chains have become the strength of traditional retailers. Supported by the largest wholesalers, they match other forms of retail, both with their offer and the level of customer service as well as modernity. The standards of shopping in stores of such chains as Groszek, Delikatesy Centrum, or Eurosklep, supported by Eurocash, as well as Livio, Nasz Sklep and Rabat Detal under the auspices of the Specjał Capital Group, are no different from those offered by ownership chain stores.

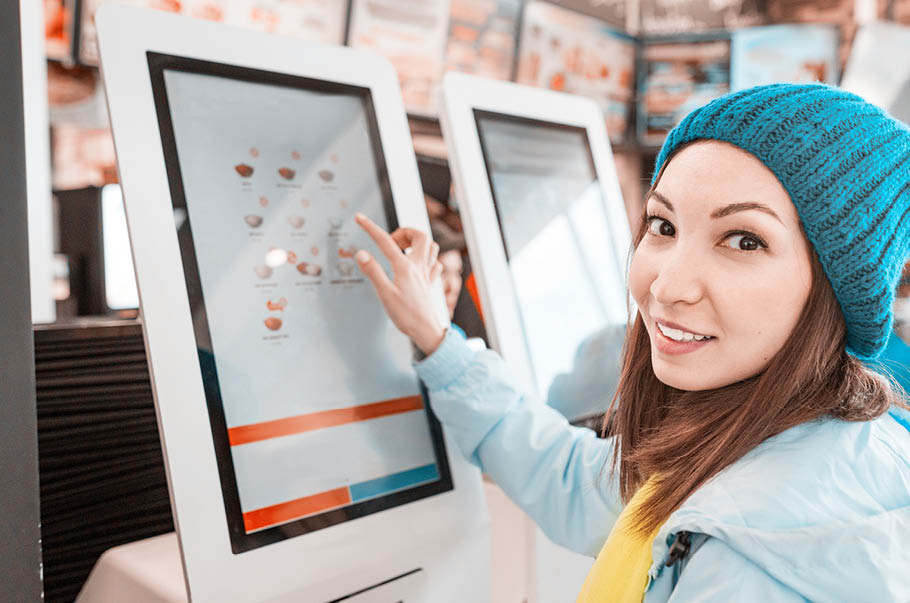

In this context, the retail market already seems to be in order. The place of individual store formats has been determined, and the favourable market situation persisting for several years and the growing retail sales cause all trade chains to make efforts aimed at the modernization of their functioning. This is about better utilization of the resources at hand, mainly through IT processes and robotizing of a part of their operations. Modern software is being introduced, and automation of shopping processes is becoming increasingly common. There are even shops with no cash registers, and online trade, also in food, is slowly starting to ripen as well.

Witold NartowskiJournalist